I have two pieces of news, one good and one bad. The good news is that you don’t have to be a genius to invest. The bad news is that you’ll need discipline and patience to believe it.

What’s the best investment right now? This is the question I hear every time someone discovers what I do for a living. No one wants a reasonable answer; they all want the next “big opportunity” that will make them rich.

Caring about your investments is important, but obsessing over getting the highest returns can be counterproductive. You may be tempted to take credit for your ‘winners’ but also beat yourself up for your ‘losers’. The truth is, the outcome of an investment isn’t always within your control.

Instead, why don’t we pay more attention to the things we can control?

People are fascinated by the savvy of great investors. However, for most people, time and savings rate are what make the difference.

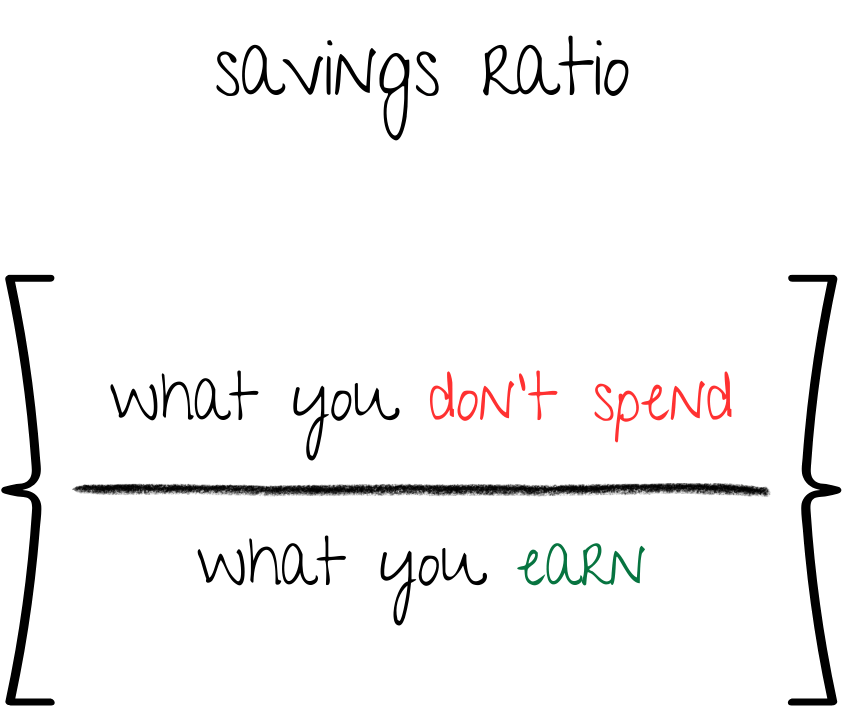

The savings rate is the percentage of income you don’t spend. For example, if you earn £1,000 and save £100, your savings rate is 10%.

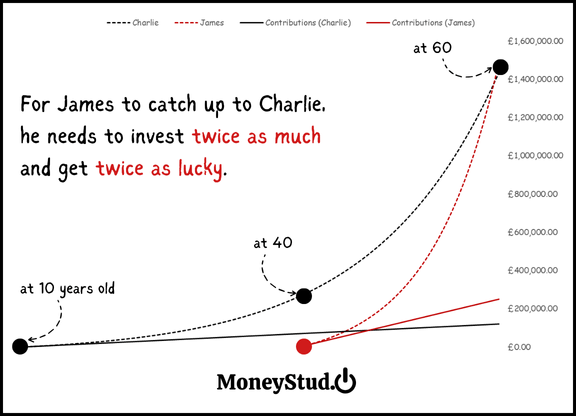

Charlie was lucky enough to start investing at the age of 10. His parents understood the importance of starting early and decided to invest £200 a month. During his teenage years, Charlie saw the advantages of long-term investing. So, when he finished university, he continued saving.

Sometimes the market goes up, and sometimes it goes down. Charlie doesn’t mind. He never paid too much attention to his investments. He simply trusts that a diversified portfolio will benefit from the success of the greatest companies of the world, those that sell the products we love and know how to innovate to keep growing.

With a monthly saving of £200, from age 10 to 60, and an annual return of 8%, Charlie could accumulate close to £1.5 million.

On the other hand, there’s his friend James. Like many young people, James never worried about saving, sometimes because he couldn’t, other times because he didn’t want to.

Although both attended the same university and work for the same company, James spends a lot more than Charlie.

By the time he turned 40, with only £10,000 in savings, James realised he needed a change. Despite having a life full of comforts and luxuries, there was something he missed: freedom.

Freedom to change careers, take a sabbatical year, or spend more time with family.

What would James need to do to accumulate Charlie’s wealth by the age of 60?

Unlike Charlie, James will only have 20 years to invest and would need to save £1,000 a month, in addition to achieving an annual return of 15%.

Despite assuming an extremely optimistic return, James would have to save a total of £240,000 (£1,000 x 12 months x 20 years), double the £120,000 that Charlie needs.

The reason Charlie can accumulate his wealth by saving less is because his money’s had much more time to grow. Additionally, the return he expects to achieve (8%) is much more realistic than James’s (15%).

Do you remember those weeks of intense study before an exam? Charlie was the type who studied a little every day, while James left everything until the last minute. One requires discipline, the other luck (and a lot of caffeine).

Remember, the return on your investments is only part of the success. What you really need is patience and saving discipline, both of which you can control.

*The average annual return of global equities (using the MSCI AC World Index as a reference) from December 1987 to August 2023 has been 8.45%. Past performance is not indicative of future returns.

*Calculations use a constant rate of return (ignoring taxes and transaction costs). In the real world, equities have both positive and negative periods.