Savings are simply the difference between what you earn and what you spend. The world is full of experts who have the key to make you “earn more”, but few teach you the importance of spending less. Wanting to live with less doesn’t mean you lack ambition; it means understanding that money only solves money problems. Nothing more.

This is common sense. However, sometimes our spending tries to solve problems that money can’t fix, particularly issues related to ego or insecurity.

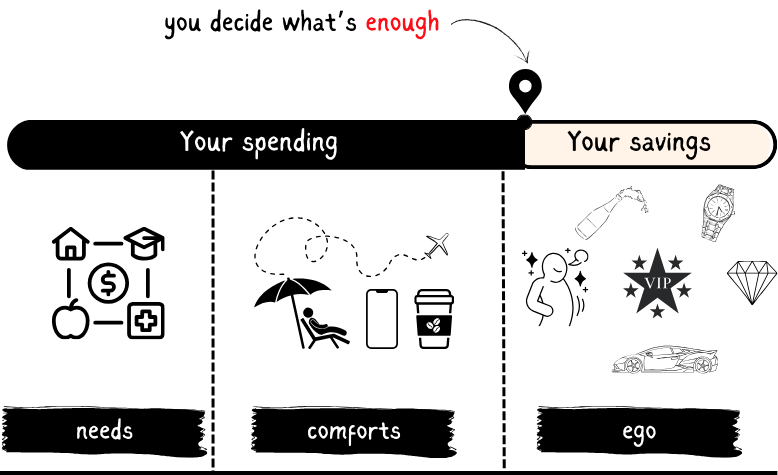

Your understanding of spending is unique and personal. There is no scientific basis for it. From my point of view, spending can be divided into three categories: needs, comforts, and ego.

Needs: Cover the basic expenses required to survive day to day, such as food, water, and electricity.

Comforts: These are the things that are ‘nice to have’, whether family holidays or small pleasures like a coffee. They also include products that make your life a bit easier, like a smartphone or a washing machine.

Ego: These are the expenses that masquerade as “comforts” but, in reality, aim to project an image of success to others. Social status and hierarchy have always been important to humans, and it would be naive to think that these impulses don’t influence our spending.

Remember, these categories are entirely subjective, and what one person considers a comfort, another might see as an ego expense. The important thing is to recognise the difference in your own spending.

How do you do this? Start by being honest with yourself. Only you know how a product makes you feel, but generally, those you use in front of others are the most susceptible to ego.

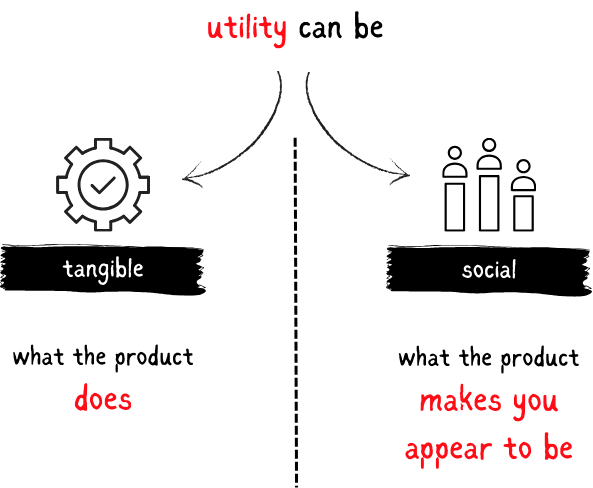

The products you buy offer utility. This means they improve your life in some way. While some products offer tangible utility (like a mattress), others offer intangible or social utility. The price of a Rolex, for example, is not justified by its ability to tell time but by its utility in terms of status.

Products that offer primarily social utility are known as aspirational goods. These are often perceived as symbols of success and have always existed.

Treating yourself to satisfy your ego isn’t necessarily wrong, as long as it’s done in a controlled manner.

When I suspect that an expense might be driven by ego, I try to answer these questions (as honestly as I can):

1) Can I afford it?

It’s essential to have a budget that allows you to control your spending. If you can cover your basic needs, take care of your family, pay off your debts, and save for your future according to your financial plan, what you do with the rest of your money is no one’s business.

2) Is this an expense that brings me closer to my goals?

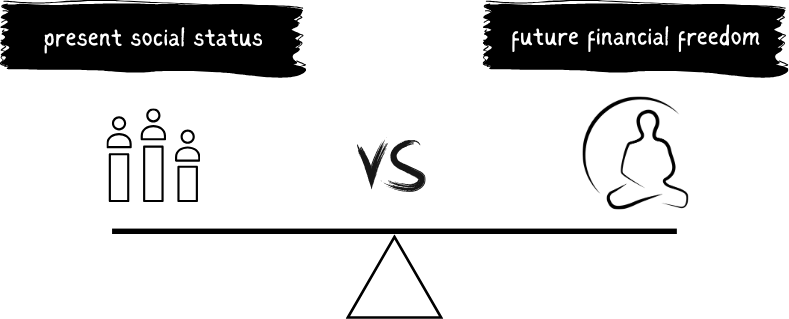

“Ego expenses” represent an exchange where you give up some of your financial freedom in the future (your savings) to improve your social status in the present.

But what if improving your status could bring you closer to your goals? This could be the case for a content creator who buys designer brands or a young consultant who wears high-end suits to improve their image and get a promotion. Each person has their own unique path. The problem is that we often confuse others’ goals with our own, taking on expenses that don’t make sense.

3) What am I really buying?

The harsh reality is that ego expenses often hide insecurities and try to solve problems that money can’t fix.

We all like to feed our ego from time to time. The problem is believing that a particular situation, a designer garment, or a luxury car changes who you really are. This is how spending can become an addiction without limits.

The temptation exists for every budget. If you have a £100 watch, you might aspire to a £500 one. If you have a £500 one, you might aspire to a £5,000 one. And so on, until you reach millions of pounds. In the realm of ego, prices increase exponentially.

Ego expenses don’t have a natural limit, unlike products that offer tangible benefits (such as quenching thirst or hunger). However, feeling loved, admired, or important is a much more complex desire and perhaps impossible to satisfy with money. Your discipline is the only way to limit ego spending.