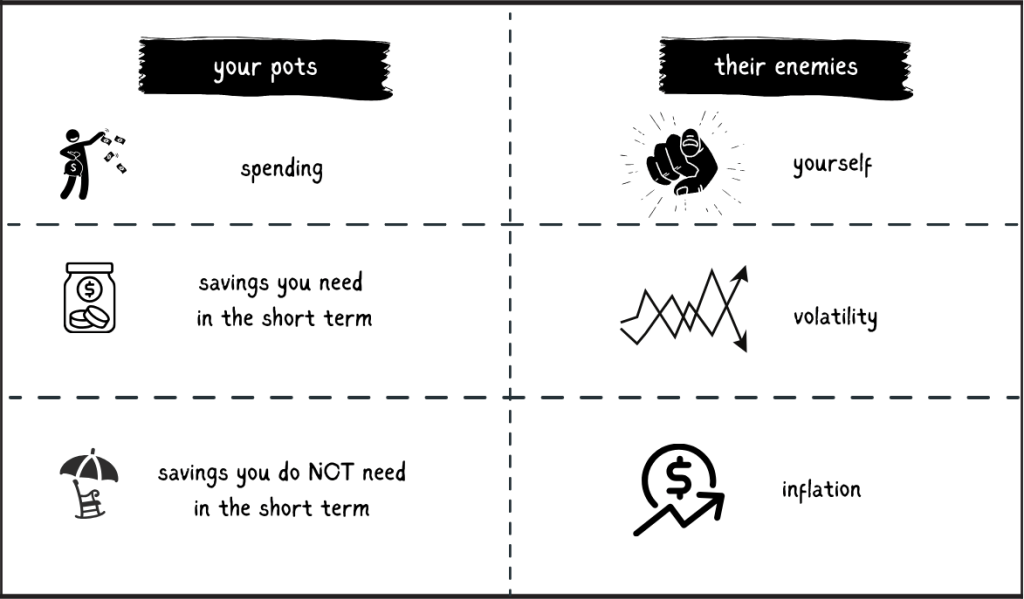

Your time doesn’t always serve the same purpose —each moment of the day requires a different version of you. Similarly, depending on your objectives, you can separate your money into different pots, each serving a different purpose.

Spending

This is the money you need immediately. As soon as you get paid, daily expenses start invading your current account: mortgage, utilities, food, memberships, subscriptions, leisure, etc. Unless you have passive income—that doesn’t require your time—you will need to save. This means you must restrict your current spending to preserve your lifestyle in the future. This requires discipline, and therefore, you are the one who makes the difference.

Savings for the short term

But before thinking about the future, it’s important to save for unforeseen emergencies. These are the expenses that catch you by surprise and aren’t covered by insurance. We call this pot an ’emergency fund’, and its main function is to be available immediately. Emergencies are inevitable, but being well prepared depends on you. Your emergency fund must be immune to market movements, as its purpose is not to grow but to protect you.

You probably know the meaning of volatility, but just in case, I’ll summarise it in one sentence: when the prices of shares (or other assets) move a lot in a short time, it’s called high volatility. In short, volatility allows us to measure the current level of “turbulence” in the markets. When a pot has a short-term purpose, fear of volatility is justified. However, this fear often irrationally extends to other pots with a more distant purpose.

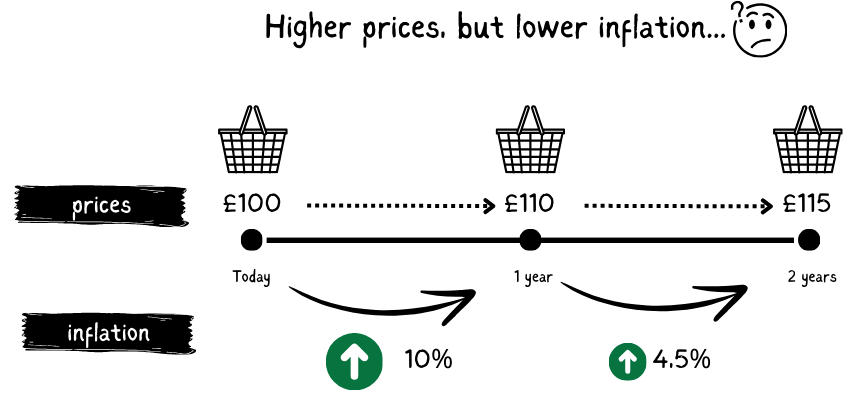

Avoiding volatility seems like a sensible decision. However, this exposes you to an even greater risk: inflation. Inflation measures the rise in prices. For example, if your shopping basket goes from costing £100 to £110, it means inflation is 10%, lowering the value of your money.

Important: When you hear that inflation has “fallen”, it doesn’t mean prices have dropped, but that they have risen more slowly.

At certain times, inflation spikes and becomes a cause for concern. However, most of the time, it acts stealthily, eroding the value of your money little by little.

Other pots that share similarities with your emergency fund could be savings for a mortgage deposit, a car purchase, or a holiday. All these have a specific and near-term goal—usually less than five years. When the time comes to “break the piggy bank”, the last thing you want is to see their value suddenly plummet, leaving you without a house, car, or holiday. In the short term, market volatility is your worst enemy.

Savings for the long term

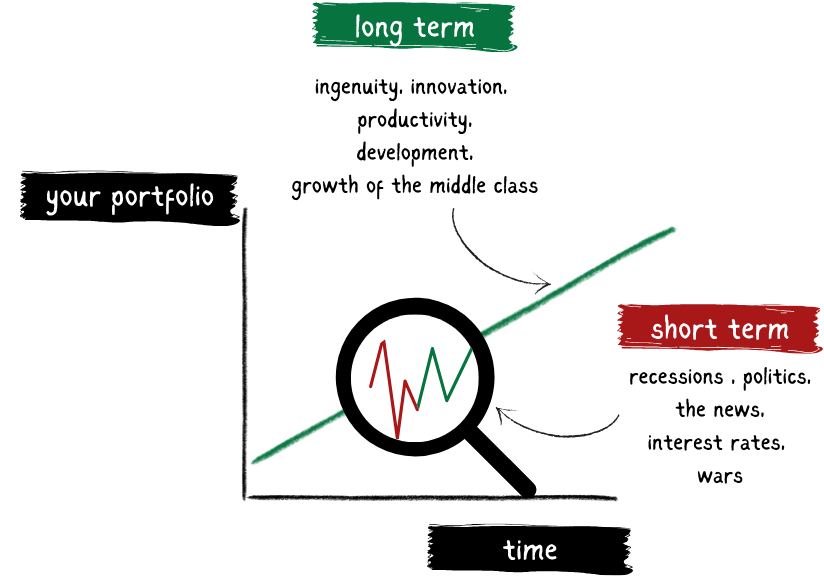

When a pot has a long-term goal, like your retirement, inflation becomes the main threat. Your ability to feel “comfortable” with volatility depends on your financial situation, risk tolerance, and market knowledge. Having said that, it’s important to recognise that the level of uncertainty in investments decreases over the long term, as the factors driving growth tend to prevail.

In the short term, the market often overreacts to any event—whether it’s a change in interest rates, a potential recession, or an international conflict. To avoid that frustration, you must focus your attention on what really matters: society’s ingenuity and drive for innovation.

When you understand that your pots face different enemies, you can design unique strategies for each one.