Leverage is a common yet little-known phenomenon, and it can be defined as the ability to achieve more with less. Just as a megaphone amplifies the sound of your voice, leverage multiplies the results of your effort and the returns on your investments.

Not too long ago, an artist’s work went unnoticed beyond their immediate surroundings. However, recent technological advances have made it possible to spread talent at virtually no cost.

Leverage exists in many areas.

In Time…

Just as an artist can reproduce (and sell) their music indefinitely, there are other ways to leverage your time. From publishing a blog to programming an app —anything you can produce once and then reproduce at no additional cost..

In Investments…

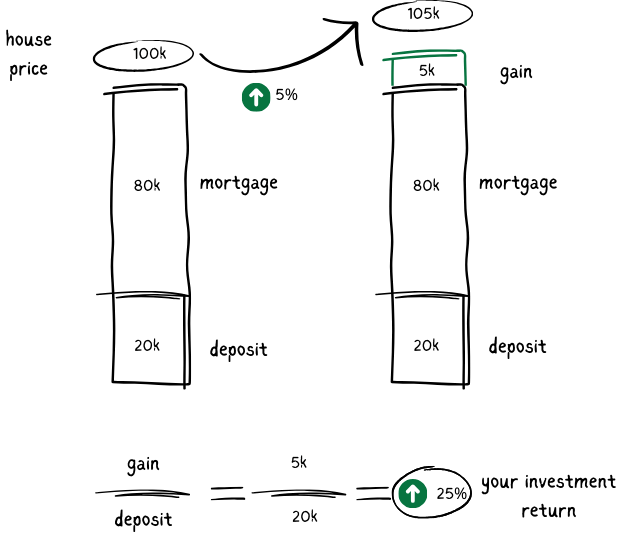

If you have a mortgage, it means you have made use of financial leverage. The mechanics are simple: you put down a 20% deposit and the bank lends you the rest. In this example, let’s assume the property has a price of one hundred thousand pounds.

If the price increases by 5% next year, the house would be worth £105,000. That means you would have a gain of £5,000. Since you only invested the £20,000 deposit, it means your investment has grown by 25%. Therefore, the growth of your investment (25%) is five times higher than the growth of the property price (5%). That’s how leverage multiplies the return on your investment.

Many people think that buying property is “the best investment”. Although it is true that property prices have been rising over the years, what really makes the difference is leverage. However, remember that leverage is a double-edged sword. If the property price were to fall by 20%, it would be equivalent to losing 100% of your investment.

Leverage has immense power to create wealth but also to destroy it, as happened during the property crisis of 2008.

In Businesses…

Leverage can also be observed in the business models of some companies. Take Microsoft Office, a product you probably use in your daily life. Microsoft has fixed costs associated with the initial development of its programmes, the server infrastructure, and system maintenance.

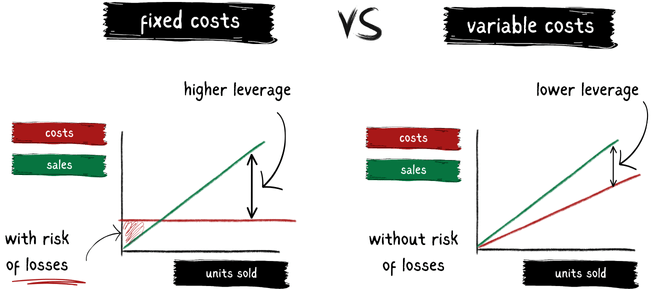

Fixed costs are those the company incurs regardless of the number of customers who buy their product. As the number of users grows, Microsoft can sell its product without its costs skyrocketing. This means that sales growth translates into even greater profit growth.

To understand the effect of leverage on businesses, let’s compare two types: one with only fixed costs and the other with only variable costs.

Understanding the power (and risk) of leverage can be key to your future. Not only in your investments but also in how you decide to invest your time.