No one wakes up wishing their life were worse. Thousands of years of evolution demonstrate an innate ambition to improve our quality of life. Advances in medicine, agriculture, industry, and technology have been radical. However, the negativity in the media prevents us from appreciating this reality.

I will give you four reasons to alleviate your fear of investing. But first, I want to tell you a story.

In a small workshop in his hometown, Mr. Ernest spent nights by candlelight designing all sorts of tools and machinery for farming. The harshness of a life without running water, electricity, or medical care was evident on his face.

The market was only ten kilometres away, but the only path was a dirt track that turned to mud with every rain. Dragging the goods could take him hours or even days.

Without access to modern technology, communicating with customers required exhausting journeys on foot. Mr. Ernest knew that the best way to promote his reputation was through the quality of his products and innovation. What he never imagined was that his small workshop would change the lives of millions of people.

After over a hundred years of growth, Mr. Ernest’s workshop is now a large global company called Ernest AgroTech. With a presence in different countries, the company is a world leader in the design and production of agricultural machinery. Its innovative culture promotes the use of drones, satellites, robotics, and artificial intelligence, enabling its clients to optimise crop management.

Mr. Ernest’s vision made it possible to produce more food with fewer resources, contributing to the fight against hunger worldwide.

Nice story, but now let’s take a look at this article published in today’s newspaper:

Middle East Conflict Raises Agricultural Costs and Slashes Ernest AgroTech Shares by 20%

“The recent eruption of hostilities in the Middle East has caused a sharp increase in gas prices, with a domino effect severely impacting the agricultural industry. The rising cost of fertilisers has forced farmers to delay purchasing new machinery, directly impacting multinationals like Ernest AgroTech PLC. This giant in agricultural machinery sales has seen its shares plummet by 20%, dragged down by the downward revision of growth projections for the sector.”

As an investor, this drop has hurt you. Should you sell your shares? I don’t know. But I assure you that the fear of losing your money will make you forget the company’s impeccable track record.

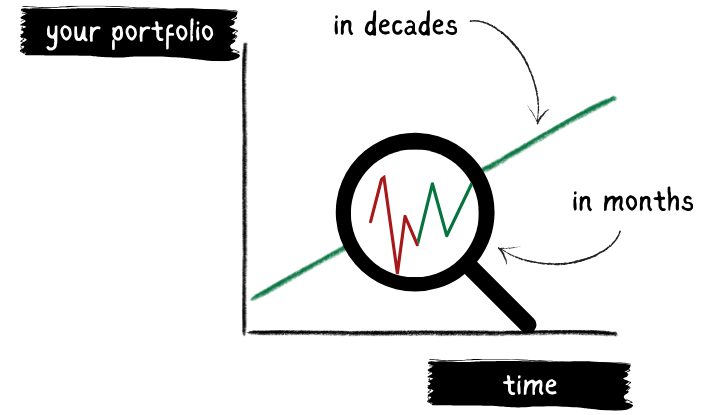

Remember, your mind overestimates present problems and ignores the progress made over decades. The key to being a good investor is to do the opposite.

This is just one example of how short-term noise can distract you. However, the success of your investments will never depend on a single company, but on the progress of society as a whole. Therefore, your only concern should be understanding why companies grow over time. These are the four most important reasons:

Increasing Customer Base: Companies can sell their products to more people, not only due to population growth but also because of the increase in purchasing power. Repetitive tasks have been automated, allowing us to use our skills where they are most needed: services, creativity, management, and innovation. Access to better jobs means higher wages, enabling companies to find new customers for their products.

Continuous Innovation: Companies never stop looking for solutions to new problems. All products go through a cycle: introduction, growth, maturity, and decline. However, this cycle repeats indefinitely. Society keeps inventing. Always.

Productivity Improvements: Companies learn to do more with less. Productivity improvements allow companies to increase their profit margins, whether through cheaper energy, robotics, or artificial intelligence.

Value Creation: Meeting needs is immune to inflation. When a company creates products to improve the lives of its customers, it is said to have created value. The concept of value (unlike price) usually remains constant over time. For example, the price of popcorn at the cinema is much higher than 20 years ago, but the enjoyment is the same. Although inflation can negatively impact your investments in the short term, companies can adjust the price of their products, thus maintaining the value of your money.

In the short term, crises are inevitable. In moments of panic, remember these four points and move on.