Today’s James’s birthday, and his colleagues have organised a grand farewell after forty years of service. Over the past few months, James couldn’t stop thinking about his retirement: a change of routine, new hobbies, places to visit. Unfortunately, everything changed in an instant when his pension plan plummeted by 30%.

His excitement turned into anxiety and helplessness. James had ‘reduced’ the risk of his pension plan by selling most of his shares to invest in bonds —a safe, low-volatility investment (or so he thought). This could undo decades of sacrifice, putting his retirement at risk.

After reading James’s story, your immediate reaction might be “never invest in bonds“, but this would be the wrong conclusion. In this article, I’ll explain why bond prices can change sharply despite being considered a ‘lower-risk’ investment.

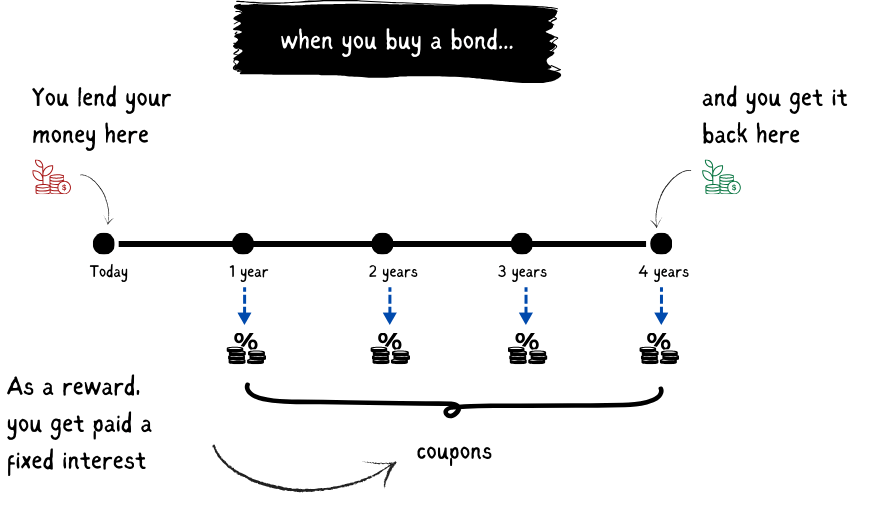

Bonds are based on the ‘promise’ that the government or company will repay the money you’ve lent them on a specific date, as well as a fixed return each year in the form of interest, also known as ‘coupons’.

Why are bonds considered a lower-risk asset?

Bonds offer a ‘fixed income’, which allows you to know exactly how much interest you’ll receive and for how long. For example, if you lend the government £100,000 for the next ten years at an interest rate of 4%, you know you will receive £4,000 a year during that period. Except in rare cases, the government usually pays its debts since it has the power to raise taxes or “print” more money if necessary.

On the other hand, when you lend money to a company through ‘corporate bonds’, you have preference over shareholders when it comes to receiving interest and recovering your money in case of bankruptcy. The interest on a bond is an obligation for the company, while shareholders’ dividends are optional.

If a bond offers a fixed income, why does its price move?

The two main reasons are: credit risk and duration risk.

Credit risk is simply the risk that the company goes bankrupt and does not repay the loan. Faced with this possibility, you will find it difficult to sell the bond, causing its price to fall.

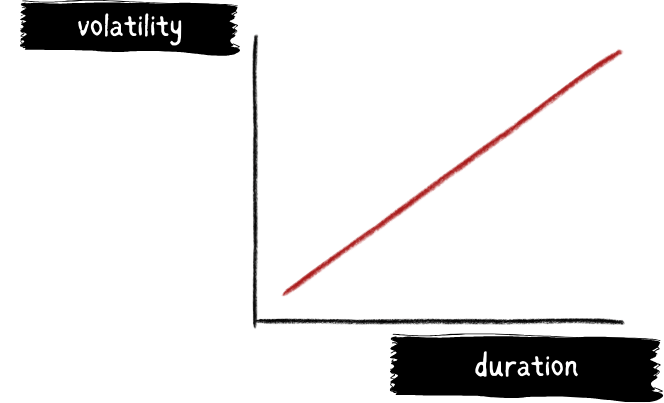

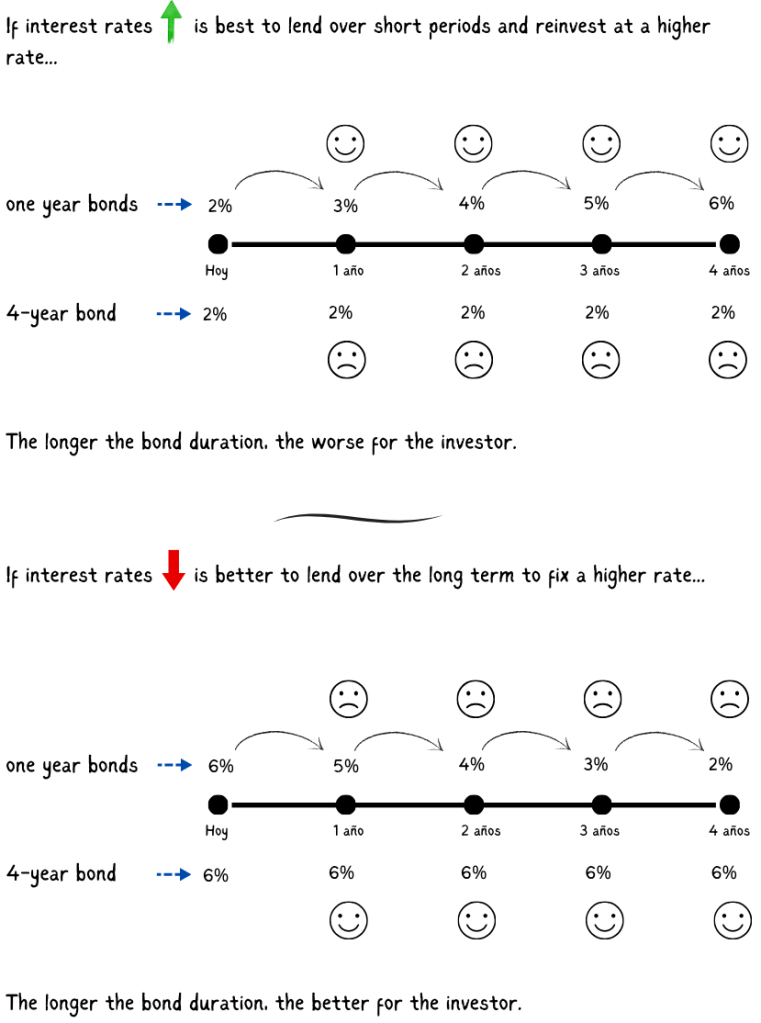

Duration risk is related to changes in interest rates: when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. The magnitude of the drop (or rise) in a bond’s price will depend on how far away its maturity date is, that is, the specific date on which the government or company promises to repay the loan. The further away the maturity, the longer the bond’s duration and the greater the impact on its price when interest rates change.

After several decades of low inflation and near-zero interest rates, James ignored the duration risk. Despite having government backing (low credit risk), the sudden acceleration of inflation and, consequently, the rise in interest rates have had a negative impact on bond prices, causing the value of his pension plan to fall.

The moral of this story is that we often believe the current situation will continue into the future. James got used to living in a world where inflation barely existed, and a fixed return of 2% was considered a “bargain.” Now that inflation “has returned”, investors are wondering if a fixed return of 5% is sufficient.

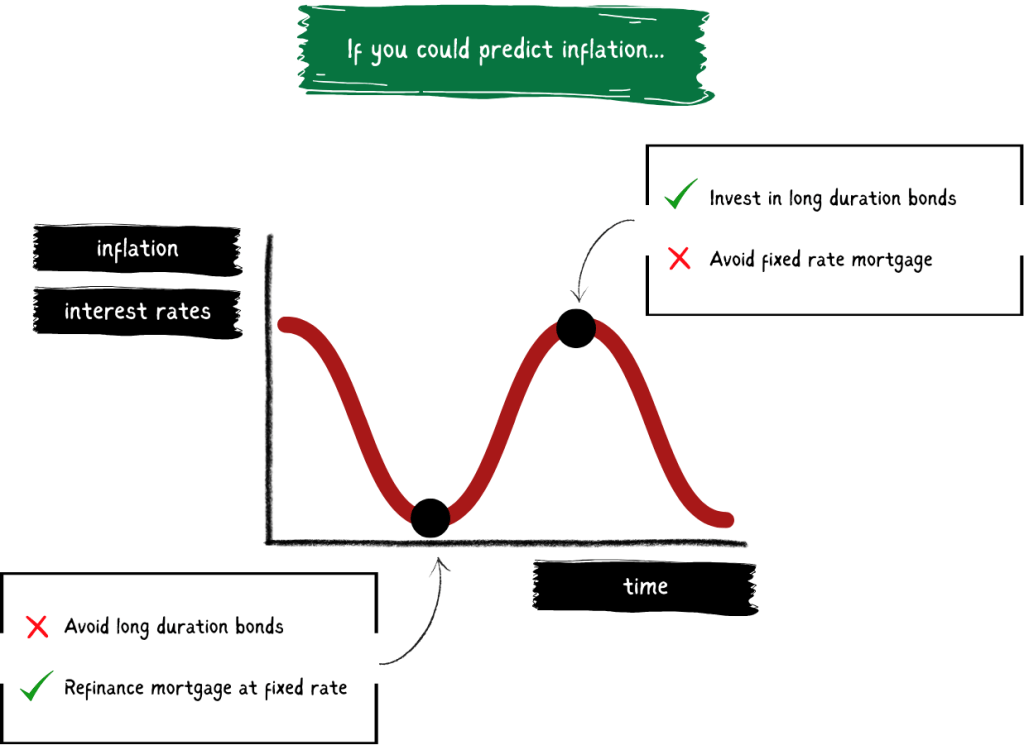

Investing in bonds follows a logic opposite to taking out a mortgage: when interest rates are low, you want to lock in that rate for as long as possible; when rates are sky-high, you might prefer a variable-rate mortgage.

The graph makes it seem simple, but in reality, you will never know for certain when is the best time to invest in long-term bonds or refinance your mortgage; there is always the possibility that interest rates will keep rising or falling. However, it is important to understand the factors that influence bond prices and when the odds are in your favour.