An asset is something you own that can generate income, such as a rented property, shares in a company, or something that pays interest.

Some assets are tangible, such as a house. These are known as physical assets. Others, like shares and bonds, are intangible and exist only “on paper”. These are called financial assets.

Besides your home (if you own one), most of your investments are likely financial assets, especially shares and bonds.

There are millions of assets in the world, and these are grouped into “asset classes” based on their characteristics.

What are the asset classes you can invest in?

Before we proceed, a word of advice: don’t be intimidated. You don’t need to be an expert to invest. Fortunately, there are investment funds and managers who can handle this for you at a reasonable price.

I believe having basic knowledge about “what happens to your money” can boost your confidence. My goal is to make the investment world more accessible, but if this article gives you a headache, just skip to the next one. Don’t let complexity become an excuse not to invest.

With that said, let’s explore each asset class:

Cash: This is the money you have in the bank, whether in a current account or a short-term savings account. This money is readily accessible, which in financial jargon is known as ‘liquidity’. Liquidity is important because it allows you to handle emergencies or make quick investments without waiting to sell another asset. Although cash carries no short-term risk, inflation can erode its value over time.

Bonds: These are loans that you, as an investor, make to the government (when buying ‘gilts’) or to a company in exchange for annual interest (known as coupons). In addition, the company or government commits to returning the money on a specific date. If you need the money before this date, you can sell the bond to another investor, although the sale price may be higher or lower than what you initially paid.

Bonds offer a fixed income and priority over shareholders in terms of repayment, making them generally lower-risk investments. However, bonds can fluctuate due to changes in interest rates. Read more in this article.

Shares: Represent small parts of a company. When you buy shares, you become one of the owners of the business, sharing both the risks and the benefits. Unlike bonds, where interest payments must be paid by the company, dividends from shares are optional and depend on the business’s success. Although they carry a higher risk in the short term, shares offer the highest potential returns. In this article titled ‘Why do companies grow?’ I give you four reasons.

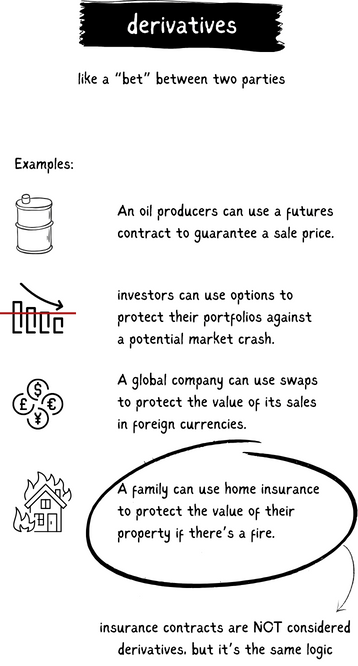

Derivatives: Imagine you make a bet with a friend on the future price of a company’s shares, like Barclays. If the price goes up, he buys you dinner; if it goes down, you pay. Neither of you owns shares in Barclays. However, the outcome of your bet depends on its share price.

The bet is a derivative, and Barclays is the ‘underlying asset‘.

There are many types of derivatives, but generally, here’s what you need to know:

A financial derivative is a contract (or “bet”) between two parties whose value depends on the price of another asset (underlying).

Derivatives are mainly used to 1) hedge risks or 2) speculate.

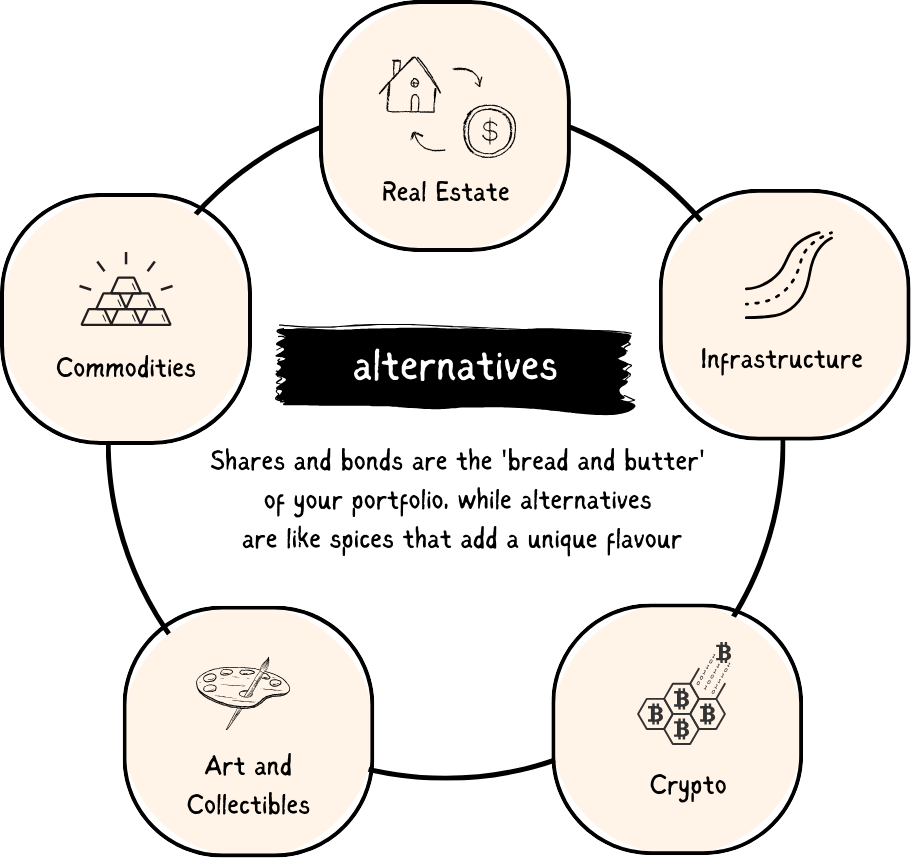

Alternative Assets: This asset class is like a “catch-all”. It includes all types of investments other than shares or bonds. The purpose of alternative assets is to increase the diversification of your portfolio. In other words, if your shares and bonds plummet at the same time during a crisis, do you have any other assets to shield your portfolio from that crisis?

The most recognized alternative assets include:

Real Estate: Houses, buildings, or land. For many people, this asset (their home) constitutes a significant part of their wealth.

Infrastructure: Projects and services essential for the functioning of society:

- Transport (roads, bridges, etc.)

- Water supply and resources

- Telecommunications

- Energy generation and transmission

Commodities: Investing in natural resources like gold or oil.

Art and Collectibles: Any valuable item that may be worth a fortune in the future.

Cryptocurrencies: Digital money, created and protected by codes, which allows anonymous transactions on the internet. Cryptocurrencies can dramatically change in price in a very short time.

Before we continue, a brief recap:

The economy exists to solve society’s problems. Each attempt to solve a problem represents a project (or business). Projects require initiative and resources. These resources cost money, which requires financial capital.

Financial capital is simply the money accumulated by people who spend less than they earn.

Your financial capital can support a project in several ways, whether buying shares, bonds, or even resources (such as commodities). These are called assets, and each has specific characteristics regarding risk and expected reward.

With the vast amount of financial capital and assets available, how is capital efficiently transferred from investors to companies? This is precisely the role of the financial system.