Have you ever chipped in to a kitty? The concept is straightforward: each person contributes their money to a shared pot (the “kitty”) to cover expenses collectively. If everyone consumes roughly the same amount, what’s the point of paying separately?

Sharing a kitty not only saves you the hassle of splitting the bill but also offers more variety. Picture this: you’re spending a weekend away in Spain with a group of friends at a lively tapas bar. Each dish is crafted for sharing, so going as a group allows you to order one tapa per person—each one different—allowing everyone to sample a bit of everything, embracing the communal essence of Spanish dining traditions.

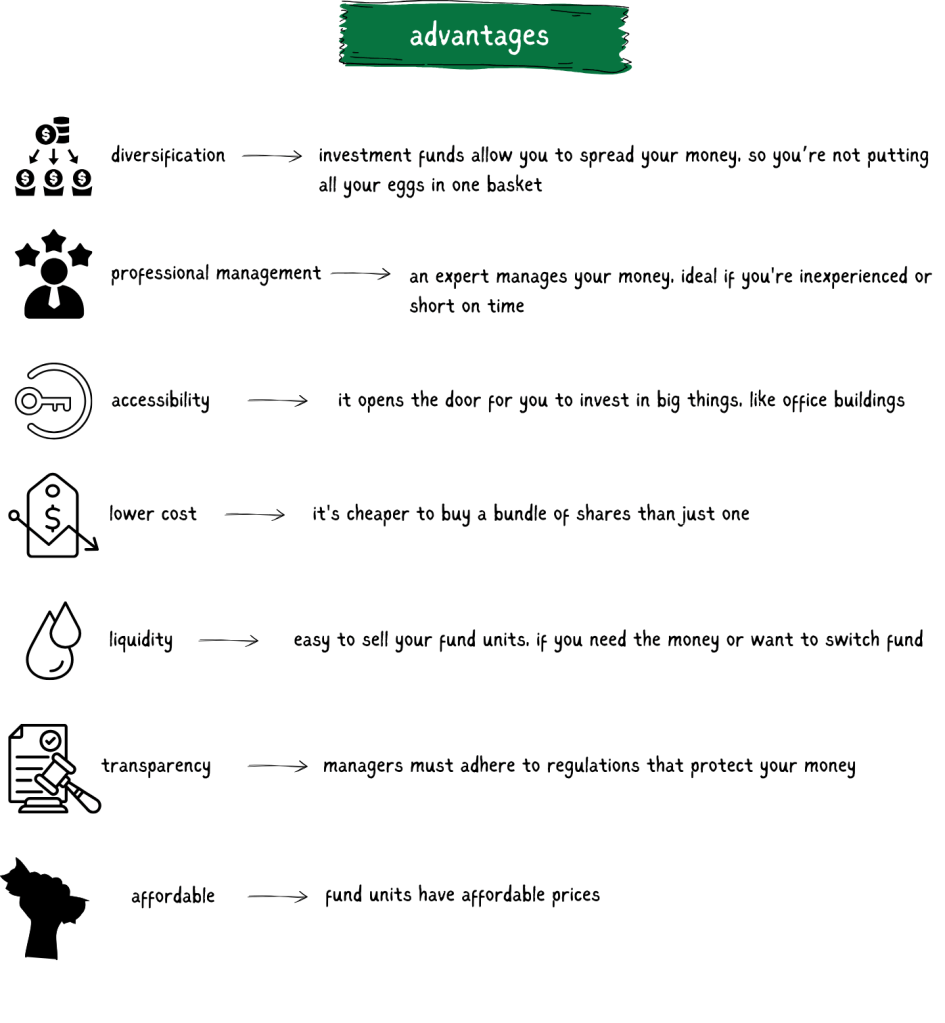

If you were to go on your own, spending the same amount, you’d have to settle for just one type of tapa. In this case, “throwing some money in the kitty” gives you variety. In investment terms, this is called diversification.

This issue is similar to that faced by small investors. If the price of a single share is around £200, what happens if you only have £1,000 to invest? You can only buy five different shares. This lack of diversification is a risk that you can (and should) avoid.

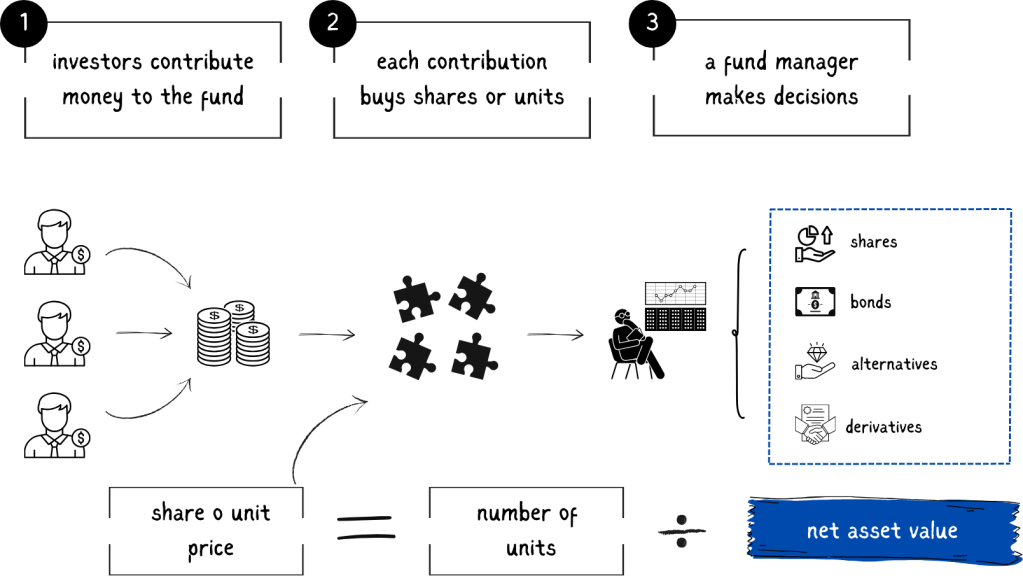

Collective investment schemes serve a similar purpose to the kitty, but instead of covering the bill, they pool and invest investors’ money together. For simplicity, let’s call them ‘funds’.

These funds are managed by experts, who have the support of analysts—like letting your chef mate take charge of choosing the best tapas.

I don’t want to bore you with regulations. All you need to know is that some funds are stricter, while others give the manager free rein to invest in higher-risk assets. This allows funds to be differentiated by their level of complexity, much like the trails at ski resorts.

A well-diversified fund that can only invest in listed assets (easy to buy and sell) would be like a ‘green run’; whereas a fund that invests in newly established private companies (startups) would be considered a ‘black run’.

Funds can be open-end or closed-end.

Open-end funds are like a big pot that’s always open for more contributions or to give some back. Imagine every time someone wants to invest, we just make the pot bigger by adding new shares. And when someone wants out, we take their portion out of the pot. There’s no cap on how many shares the pot can hold, and the price of the shares is based on the fund’s total value at the end of each day.

Closed-end funds are more like a fixed pie. Right at the start, we decide how big the pie is by issuing a set number of slices (shares). After that, no more slices are added. If you want a piece, you have to buy it from someone else who’s ready to sell theirs. This buying and selling happens all day on the stock market, where the price of each slice can go up or down, depending on how much people think it’s worth.

The price, or “how much people think it’s worth”, may be different from the total value reported by the fund (whch is know as ‘net asset value’ or NAV). If the price is greater than the NAV, the fund trades at a premium; whereas if the price is lower than the NAV, it trades at a discount.

Here’s a breakdown of some of the main fund types you might come across in the UK:

Unit Trusts, Offshore Funds, and OEICs (Open-Ended Investment Companies)

These are the most popular open-ended funds, constantly adjusting in size based on investor interest. As more investors buy in, these funds expand by issuing more shares; as investors sell, the share count decreases. Offshore funds may have a special tax perk depending on your circumstances.

Property Funds

‘Bricks and mortar’ property funds invest directly in real estate—managing everything from acquisition to tenanting. You benefit from rental income and potentially, the appreciation of the property’s value. However, these funds can be less liquid (harder to sell), especially during market downturns, as selling real estate to meet withdrawals takes time. Alternatively, there are funds which invest in shares of property companies. These funds’ values reflect the market price of the shares they hold, making them potentially more liquid than their bricks-and-mortar counterparts.

Investment Trusts

These are closed-end funds which have a fixed number of shares and are managed by dedicated teams. They can invest in a wide array of assets, including both public and private companies. Investment trusts are traded on stock exchanges like individual stocks, and their value can fluctuate based on market conditions. Real Estate Investment Trusts (REITs) are a particular type of investment trust that invests in property.

How do you know if a fund manager is doing a good job? In the next article, I’ll explain what an index is, as well as the difference between an active and a passive fund.