Ever heard of the “Footsie” or “Dow Jones”? Stock market indices often dominate headlines, especially when the market is down. The news aims to capture your attention, and fear is one of its secret ingredients. Losing money is one of the most common fears, which is why market downturns tend to make more noise than upticks, even though the latter occur more frequently (but that’s not news).

Everyone understands that rises are “good” and falls are “bad,” but what exactly is going up and down? What is the purpose of an index? How is it constructed? This article explains it all.

Indices allow you to assess the performance of a group of assets at a glance. Thousands of companies are listed on stock exchanges daily, and their prices are constantly moving. Analysing the performance of each would be a nightmare. That’s why we use indices to track the performance of assets that share common characteristics, such as being listed in the same country or belonging to the same sector (mining, banking, telecommunications, etc.).

Grouping assets using indices tries to simplify things and allows us to tell stories about what’s happening in the markets, such as “The banking sector plummets” or “The US stock market reaches all-time highs.” Next, I’ll show you how an index is built, step by step.

First, you need to decide the number of companies your index will include and the selection criteria. Imagine you want to build an index called the Top 5 ‘A’s, based simply on the five largest listed companies in the world that start with ‘A’. Currently, this index would include Apple, Alphabet (which includes Google), Amazon, Aramco, and ASML.

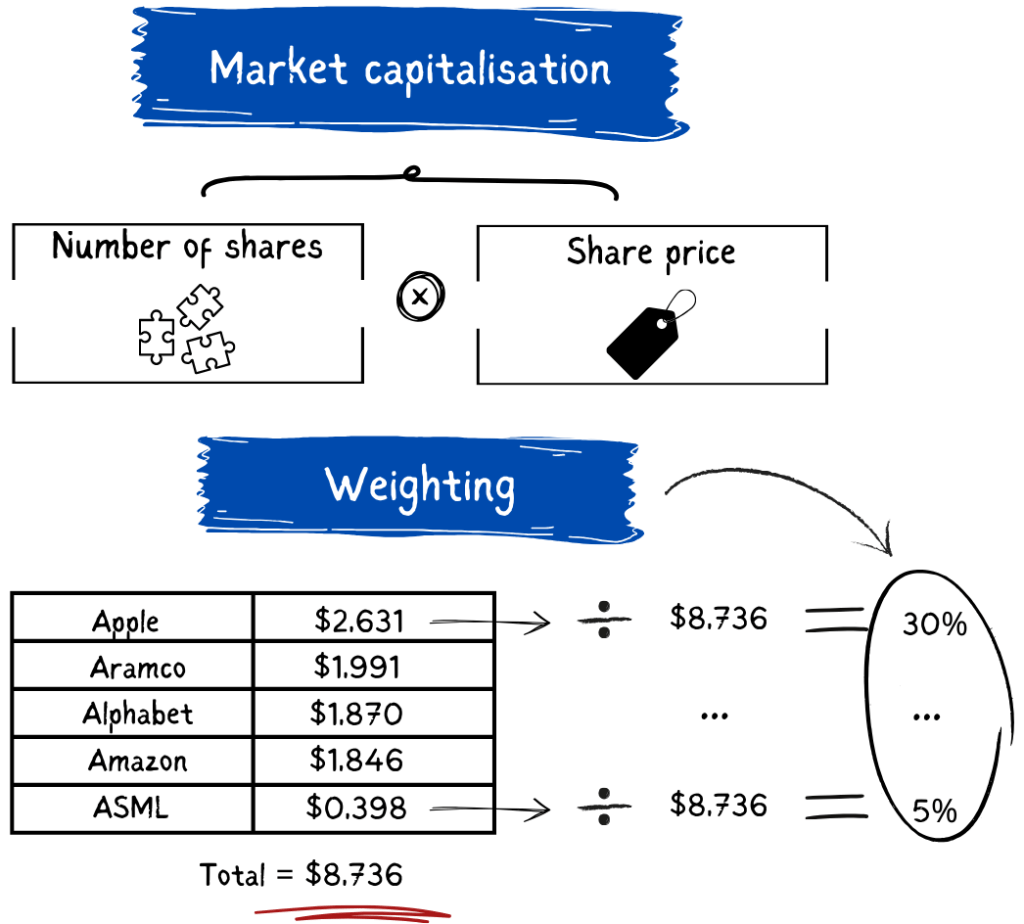

Next is to decide the weighting, that is, the percentage of the index each company represents. Think about your academic grades: each subject had a level of “importance” that represented a percentage of the overall course grade. This is what we call weighting, and it indicates the importance of each company within the index. Indices often use a market capitalization weighting, which is easily calculated by dividing each company’s market capitalization by the total market capitalization of the five companies forming the index. Here is the numerical example:

Now that you understand weighting, you know that in your index of the Top 5 ‘A’s, some companies are more important than others. For example, Apple might represent 30% of the index, while ASML only 5%. This means that a drop in Apple’s price will likely pull the index down; whereas a drop in ASML’s price might go unnoticed.

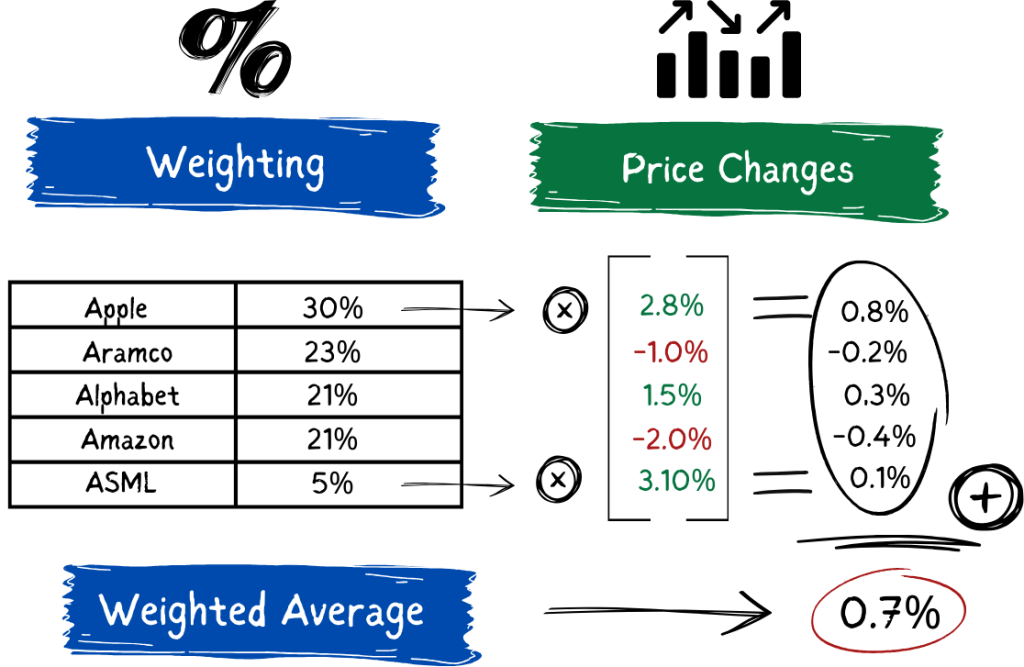

To calculate the index’s rises and falls, simply multiply the percentage change in each stock’s price by its corresponding weighting and add up the results. Once again, this is easier to understand with numbers:

Thus, the performance of the index is simply a weighted average of the performance of each of its assets.

It is important to mention that the weighting of each company changes daily due to changes in stock prices. When a company performs well over a period, its market capitalization increases relative to the rest, and therefore, its importance (or weighting) in the index also increases.

Although the Top 5 ‘A’s is a fictitious index, we could have used other real criteria, like the one hundred largest listed companies in the UK (FTSE 100) or the five hundred largest in the United States (S&P 500). There are also indices that represent specific sectors, such as banks, telecommunications, or technology.

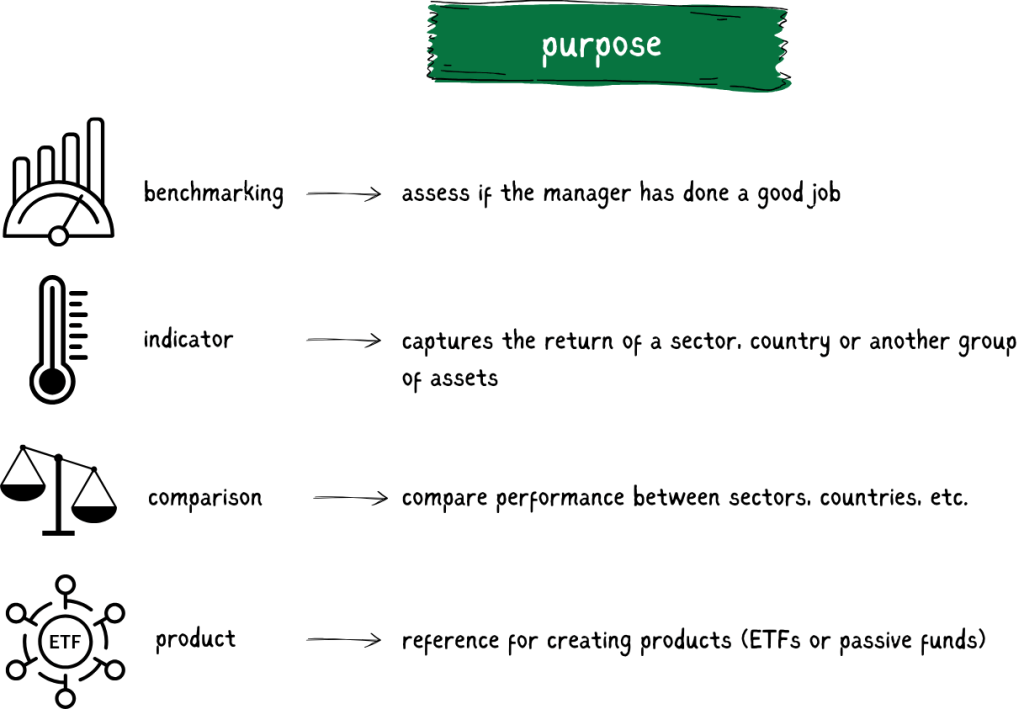

What matters is that an index captures the performance of a market. Indices are also used to compare performances across different markets (or sectors) and for benchmarking, i.e., to evaluate whether a fund manager is doing a good job.

Knowing how an index works is crucial for understanding active and passive investing. While active investment seeks to outperform an index by selecting assets with high potential according to the manager’s opinion, passive investment aims to replicate the performance of an index, typically resulting in much lower costs.

As such, indices have become the basis for many investment products, known as indexed funds. When you invest in these funds, you accept that your investments simply follow index movements. A popular alternative to indexed funds is Exchange Traded Funds, known as ETFs.

ETFs are traded on stock exchanges just like company shares. Most aim to replicate the performance of an index or a commodity, such as gold. They are known for their liquidity and low management fees, making them a popular choice for both novice and experienced investors.