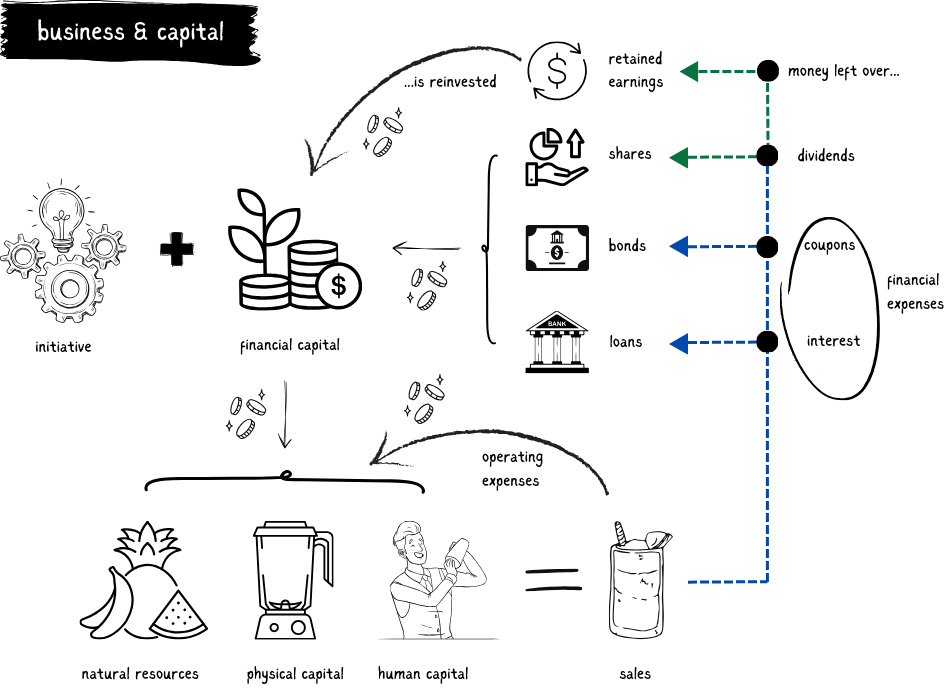

To solve problems, two things are necessary: resources and initiative.

What are the resources?

Natural resources, such as agricultural products or materials from mines, commonly known as raw materials or commodities.

Physical capital: Machinery or infrastructure such as a warehouse, a taxi driver’s car, a laptop, or a shoe factory, all designed to create products or services.

People: Specifically, their knowledge and skills. This is known as human capital.

Each of these components contributes to a value chain, where each link plays a role.

However, these resources don’t organise themselves; they require someone’s initiative.

What is initiative?

Initiative is the “brain” of the business. Someone must identify the problem, find the solution, and organise the resources efficiently. This is the role of the entrepreneur.

What is financial capital?

Resources cost money; therefore, a business needs financial capital. If initiative is the brain, financial capital is the “blood” of the business, nourishing each of the resources so they can perform their functions.

Where does financial capital come from?

Financial capital is simply the money you accumulate by spending less than you earn. Since you don’t need it immediately, this money can work for you. Just as you “rent out” your time (or human capital) in exchange for money, you can do the same with your financial capital.

What are the sources of capital for a business?

Financial capital can take different shapes.

Shares

Capital contributed by owners. Being a shareholder means owning part of a business.

Shares grant voting rights on decisions affecting the company, in addition to the right to receive dividends, which can be more or less stable depending on how well things are going. Otherwise, the company can cancel or reduce them without notice.

Loans

A business can go to a bank to ask for a loan. The bank sets certain conditions (interest rate, terms, fees, etc.). If the business fails, the bank is usually one of the first to be paid. Just in case, the bank requires guarantees, whether properties or any other valuable asset that can be seized if the company fails to make payments.

Bonds

Similar to a loan, but in this case, the company borrows money from investors. The debt is divided into equal parts called ‘bonds’. Buying a bond is like lending money in exchange for interest over a period (which can be months or years). For example, a £1,000 bond at an annual interest rate of 5% generates £50 per year. The interest you earn is called a ‘coupon’.

Retained earnings

This is the “money left over” at the end of the year after covering costs, salaries, interest, taxes, dividends, etc. When a business is successful, in addition to rewarding its investors, it can use its profits to fuel its growth. This means a business can become its own source of capital.

Why is this important to understand?

It may seem obvious, but never forget: most investments originate from an initiative that requires resources. From a business issuing shares to buy production machinery to a government issuing bonds to build roads.

Investing is not about collecting “stamps” that fluctuate in price, but about funding projects. Just like the use of your time earns a salary, the use of your money earns a return.

Without projects, there are no investments, and without investments, there are no projects.

Every project is an attempt to solve a problem. I use the word ‘attempt‘ deliberately because the “solution” might not work.

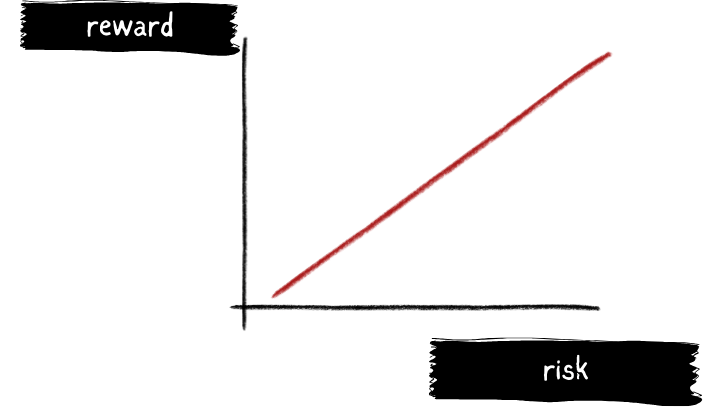

Whoever tries to solve a problem does so “blindly”, dedicating time and resources with the risk of receiving nothing in return. However, if things go well, those who take risks expect a greater reward.

There are always exceptions, but remember, every investor expects a return proportional to the risk they take. Otherwise, what’s the point of investing?

Now that you are familiar with shares and bonds, let’s complete the list with other types of assets.