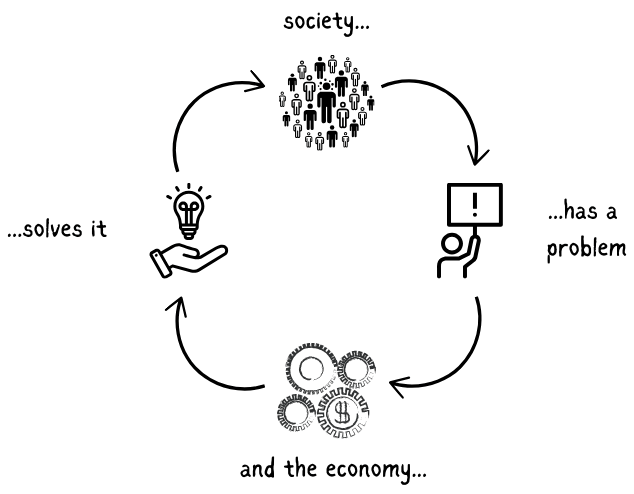

When you hear the word ‘economy’, do you think of boring and complex numbers? I’m here to show you that ‘the economy’ is much more: it’s our everyday tool for solving problems.

What is the economy really for?

Whenever a need or desire arises, society sends out a message: “Houston, we have a problem.” Immediately, the economy looks for a solution.

The economy acts as a machine that receives problems (demand) and offers solutions (supply).

Your Dual Role in the Economy:

As a Consumer

When you need something that you can’t or don’t want to get by yourself, you buy it. Buying means that someone does something for you. As a reward, you pay a price. This is called consumption, and you do it every day.

As a Producer

In addition to consuming, you are also capable of creating value and offering solutions to others. Whether by providing a service or creating a valuable product, society says, “Thank you very much. Take this money and spend it on whatever you want”. This is called production.

Your Tools: Time and Money

To consume and produce, you have two tools: time and money.

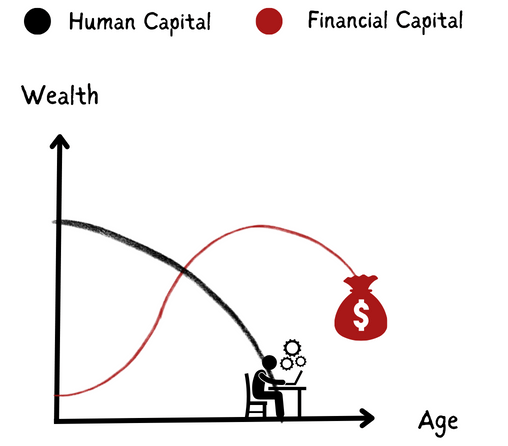

Time, or rather, what you are able to produce with your time, is called human capital; while the money you accumulate is called financial capital. This is the money you don’t spend.

When you are young, you have plenty of time ahead to produce, but little money accumulated. In old age, it is the opposite.

In the economy, everything’s connected. Sometimes you consume, sometimes you produce. Your spending is someone else’s income, and your income is someone else’s spending. This makes the economy a complex and vibrant network of human activity.

Now you know that the economy solves problems, but how does it do it? Businesses are fundamental in this process. They listen to the needs and desires of society and respond with products and services.

In the following article, we talk about businesses: where investments originate.