When it comes to money, there isn’t a simple answer. Perhaps you were hoping this blog would tell you exactly what to do with your money. But it won’t.

We all have different priorities, desires, and fears. Your money beliefs are unique. You decide what makes sense to you, not an expert or a spreadsheet.

A simple internet search gives you access to thousands of articles on “the hottest investments of the moment”. However, my blog is about the things that rarely change. Because these are the ones that really matter.

Consider me the opposite of the influencer who “earns millions” buying cryptocurrencies from a hammock in Bali. I may not get the same attention, but if I can prevent someone from making a foolish decision with their savings, the effort will have been worth it.

So these are my money truths:

Your patience and savings discipline are more important than your investment returns.

Financial success depends on three factors: savings rate, time, and investment returns. Most people focus on the third. However, the first two often have a greater impact.

Learn to distinguish between the price and the value of things.

Value is the enjoyment, pleasure, or convenience that someone or something provides. Price is simply value measured in money. The fact that the price of something is the same for everyone does not mean that its value is too. Read this article to learn why.

Your mind overestimates current problems and ignores the progress that happens over decades.

The key to being a good investor is to do the opposite. Learn to live with uncertainty and focus on what really matters. Here are four fundamental reasons that explain why companies grow in the long term.

You can’t outspend your ego.

Money only solves money problems. Nothing else. Ego spending hides insecurities and tries to satisfy much more complex desires, like feeling loved, admired, or important. If you try to satisfy your ego with money, your spending can become a bottomless pit. Read more about it in this article.

Money does not reward your effort, but the value you generate.

Unless it has an impact or improves someone’s life, your effort is useless. Learn to observe the “other side” of your work or business. In other words, not the money it pays, but the value or utility it generates for those who receive the service. In this article, I explain why this is important.

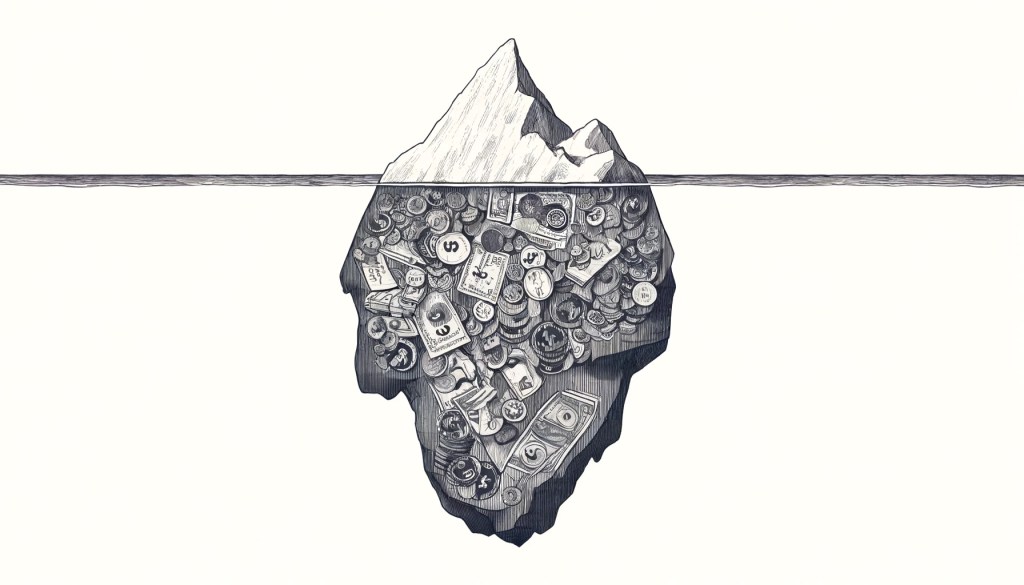

Leverage is a powerful tool.

Understanding the power (and risk) of leverage can be key to your future. Not just in your investments, but in how you decide to invest your time. The art of achieving more with less exists in many areas. Discover its power to create wealth, as well as its power to destroy it.

Know the true enemy of your money: Volatility, inflation, or yourself.

Time is organised to fulfil purposes and, according to the purpose (sleeping, working, leisure), you adopt a different behaviour. You can do the same with your money. Separate it into different pots, give them a purpose, a timeframe, and be accountable. Each pot has a main “enemy”. Read this article to know what you’re facing.

These are the ideas I try to remember often and that I would’ve liked to learn long before any formula or financial theory.